A Clear Path to the Future You Want

Because a great retirement doesn’t happen by accident. It takes a straightforward process that moves you from uncertainty to confidence, step by step.

13 Years

Of Experience

150+

Happy Clients

CFP®, CFA®

Certifications

Fiduciary

Legal Duty

Our process keeps things simple, transparent, and focused on what matters most.

It’s designed to understand your story, your goals, your family, and the kind of life you want your money to support, then guide you step-by-step through building and refining a plan that adapts as life evolves.

No jargon. No pressure. Just a clear, confident path forward.

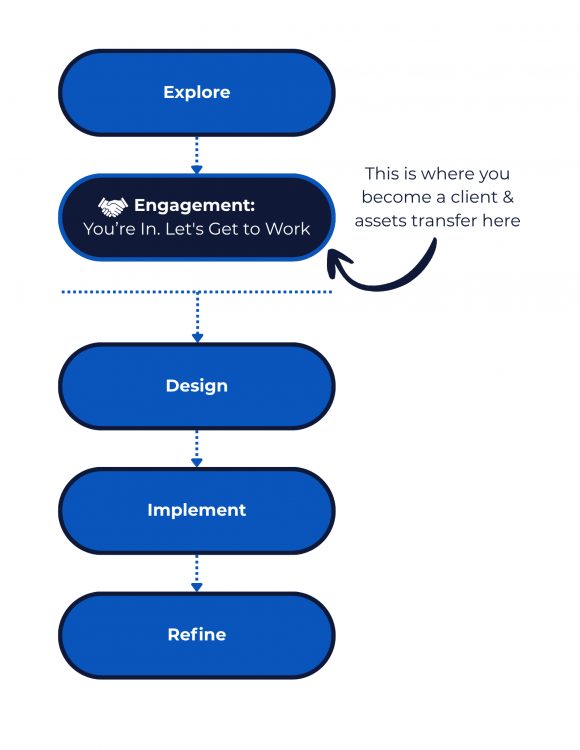

Our Process

Explore

A no-pressure conversation about your goals.

Your Explore Meeting is where it all starts. We’ll talk through where you are, what matters most to you, and what you’d like your money to accomplish. We’ll answer questions, explain how we work, and determine if we’re the right fit for your family’s financial goals.

You’ll walk away with:

- A clearer picture of your financial priorities

- Insight into how we help clients grow and protect wealth

- Next steps, if we both agree we’re a fit

Design

Turning your goals into an actionable plan.

Our team will review your current financial picture, identify opportunities, and build a tailored plan that aligns with your income, investments, and long-term goals.

This stage includes:

- A custom wealth-building roadmap

- Investment, tax, and equity compensation strategy recommendations

- Family-focused planning for college, retirement, and beyond

Implement

We put your plan into action.

With your strategy in place, we handle the setup and execution, transferring accounts, aligning investments, and making sure every piece of your plan is working together. You’ll always know what’s happening and why, with clear communication at every step.

This stage includes:

- Account transfers and portfolio setup

- Coordinating investments, insurance, and equity compensation

- Transparent progress updates and next-step guidance

Refine

Your goals evolve, your plan should too.

Life changes, markets move, and opportunities arise. We’ll meet regularly to review progress, adjust strategies, and keep your financial plan aligned with what matters most to you.

Our Ongoing partnership includes:

- Regular check-ins and performance reviews

- Updates for major life or market changes

- Continuous guidance to help you stay on track

Ready to See If We’re a Fit?

Your first step is simple. Schedule an Explore Meeting to start the conversation, no pressure, no strings attached.